Freelancer Registration in Pakistan – PSEB Freelancer Registration

As we know freelancing is growing all over the world and Pakistan is ranked 4th in the top five countries list for freelancing, software development, and technology. The reason behind it is the total revenue of $0.5 billion generated so far. The IT sector has a lot of potential and Pakistan is doing its best to rank among the top Internet Communications and Technology (ICT) outsourcing countries consistently. All this data was published by Oxford Internet Institute (OII) in 2017. To promote freelancing as many people earn money working remotely, the Ministry of Information Technology and Telecommunications has proposed a 10-year tax exemption for freelancers, as well as the PSEB freelancer registration and the removal of double taxation.

He also added that most people work hard at home after their regular professions to make decent earnings. The Pakistan Software Export Board (PSEB) is an important government agency assigned to promote Pakistan’s information technology industry in foreign and domestic online marketplaces. PSEB supports the IT industry in every project and program such as in infrastructure development, human capital development, firm capability development, international marketing, strategy, and research. We will be going to discuss all the steps for PSEB freelancer registration along with its fee and benefits.

Amazon Seller Account in Pakistan, Click here.

How to Apply for PSEB Freelancer Registration in Pakistan:

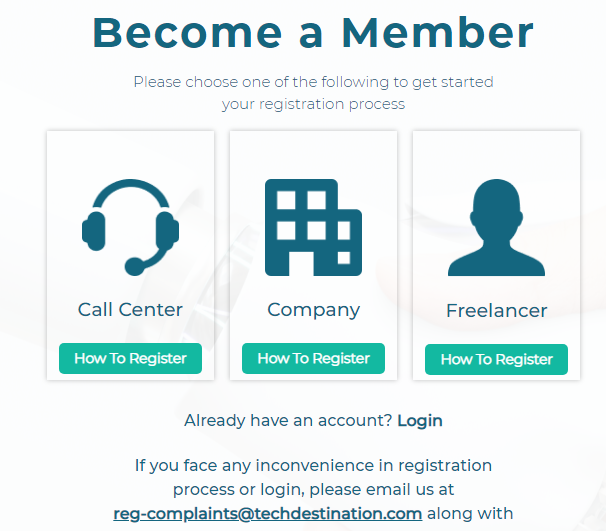

- Visit the official Pakistan Software Export Board website by clicking this link: https://app.techdestination.com/

- Click on the Registration option located above and select the freelancer option.

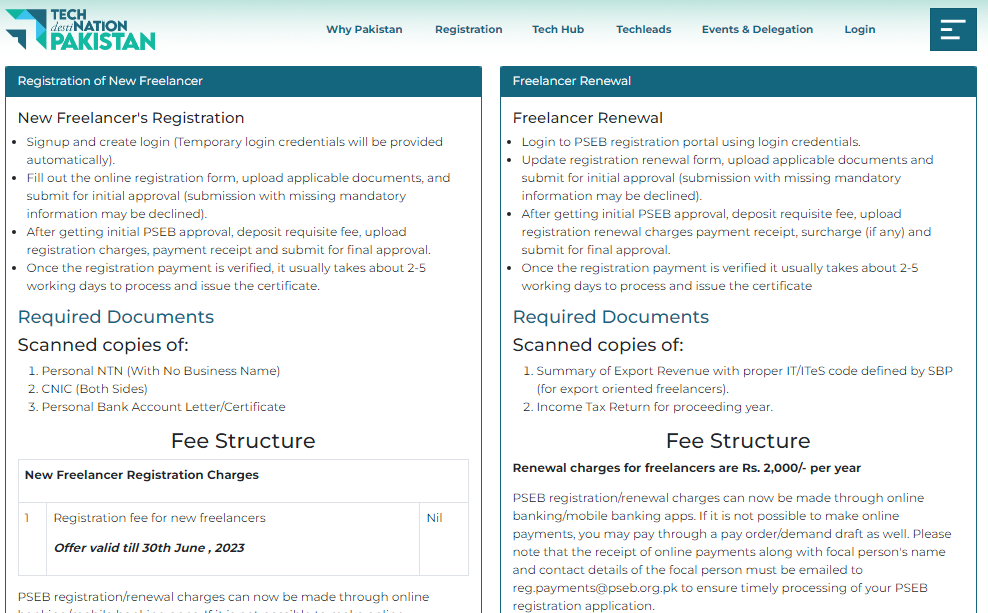

If you are a new Freelancer:

- Signup and create your account first.

- Fill out all the asked details on the registration form, upload the required documents, and submit for initial approval. Assure that you provide all the mandatory details for your application otherwise, it will be rejected.

- Once you get initial PSEB approval, deposit the necessary particular purpose fee (requisite fee), upload the registration charge payment receipt and submit it for final approval.

- Once they have verified the registration payment, which usually takes about 2-5 working days to process and issue the certificate.

Required Documents for PSEB Freelancer Registration:

- Scanned copies of Personal NTN

- CNIC (Both Sides)

- Personal Bank Account Letter/Certificate

If you have already registered as a Freelancer:

- Login to the PSEB registration portal.

- Enter the asked information in the registration renewal form, upload the required documents, and submit for initial approval.

- After getting initial PSEB approval, deposit the renewal fee, upload registration renewal charges payment receipt, and submit for final approval.

- Once they have verified the registration payment it usually takes about 2-5 working days to process and issue the certificate

Required Documents for registration renewal include:

- Scanned copies of Summary of Export Revenue with proper IT/ITeS code defined by SBP (for export-oriented freelancers).

- Income Tax Return for the proceeding year.

PSEB Freelancer Registration Fee:

The good news is that Registration is free for new Freelancers in Pakistan although there is a requisite fee that is necessary for a particular purpose. Freelancers who want to renew their freelancer registration can pay the renewal charges of Rs. 2,000/- per year. So you don’t need to pay anything for the first year apart from a requisite fee for the first time. The PSEB registration/renewal charges can be paid through online banking easily. If online payment is not possible, you can pay through a pay order or demand draft. Please remember to send the receipt of online payments along with your name and contact details via email to [email protected] to ensure the timely processing of your PSEB registration application.

PSEB Freelancer Registration Benefits:

- PSEB registration fee is Rs. 1,000 only for the first year, with renewal charges of Rs. 3,500 annually.

- Unlimited Access to PSEB programs and initiatives that include free and subsidized training, and certifications, access to ICT graduate interns for free, subsidized office space at Software Technology Parks (STPs), and international marketing and matchmaking opportunities.

- Facilitation Desk at PSEB in case need of any assistance to resolve any encountered issues related to taxation, banking, Intellectual Property rights, IP Whitelisting, or matter related to government taxation.

- 20% discount benefit from SECP on SMC (Pvt) Ltd registration.

- A loan option is also available at favorable rates up to Rs. 1 Million as part of clean lending under govt. initiative.

- Health expense and life insurance of Freelancers under some govt. initiative or program.

- Tech Travel card will be issued to Freelancers who hold a record of a minimum of three years of IT & ITeS export remittances exceeding the US $5,000 per year through formal banking channels.

- IT & ITeS export income is tax exempted for PSEB registered Freelancers that are receiving Export remittances via formal banking channels and being reported in purpose codes assigned by the State Bank of Pakistan for the IT & ITeS sector.

PSEB Online Account Details:

PSEB NTN: 2315376-8

A/c Number: 04540013165001 (Habib Bank Ltd)

A/c Title: PSEB REGISTRATION

IBAN: PK23HABB0004540013165001 (Habib Bank Ltd)